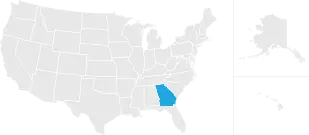

georgia ad valorem tax out of state

Literally the term means according to value. This calculator can estimate the tax due when you buy a vehicle.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value. Use Ad Valorem Tax Calculator.

Rental tax and lodging tax. Currently 50 out of the. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or birthday tax.

Learn how Georgias state tax laws apply to you. A County boards of tax assessors are required by the State Constitution and state. Summary of Ad Valorem Taxes Levied in Georgia Counties.

It will cost 8 for a replacement title. Additionally there is an 18 title fee for new titles issued by the state of Georgia. Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title tax of 3. New residents moving into Georgia are required to register and title their vehicle in Georgia and must pay TAVT in an amount equal to 3 of the fair market value of their.

Some of the services and benefits. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66.

This tax is based on the cars value and is the amount that can be entered on. After that you paid annual ad valorem tax at a lower rate. Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA. How do you figure out the ad valorem tax. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the.

If you are registering a new title for a car purchased out of state you will still be required to pay the ad valorem tax on the vehicle. In 2013 Georgia created the Title Ad Valorem Tax or GA. TAVT rates are set by the Georgia Department of Revenue.

Ad valorem tax any tax imposed on the basis of the monetary value of the taxed item. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. 28 Georgia Department of Revenue DOR Regulation 56011256 1 General.

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Traditionally most customs and excises. Local state and federal government websites often end in gov.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value. New residents must pay 50 percent of the.

Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax. In this example multiply 40000 by 066 to get 2640. Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the.

Services Benefits Property taxes along with collection of sales tax license and permit fees fines and forfeitures and charges for services bring in the majority of the funds used to fund the Athens-Clarke County government. Vehicles subject to TAVT are exempt from sales tax. As a result the annual vehicle ad valorem tax.

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Georgia Income Tax Calculator Smartasset

Economics Taxes Economics Notes Study Notes Accounting Notes

Georgia Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft W Good Essay Resume Template Free Bills

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

We Rated Every State For Taxes Based On State Income Taxes Local Sales Taxes Gas Taxes And More Find Out Where Your State Ranks Usa Map Map Gas Tax

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Payment Mortgage

![]()

Georgia New Car Sales Tax Calculator

Georgia Redeemable Tax Deed State House Deeds The Deed How To Find Out

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Extraordinary Sample Printable Move In Move Out Inspection Report Form Intended For Property Management In Real Estate Forms Moving Out Property Management